How To Calculate Additional Ctc 2024 Irs. Moreover, the child tax credit is also designed to be tax refundable, up to a limit of $1,400. The new calculation would multiply the parent's income by 15% as well as by the family's number of children.

The above calculator is only to enable public to have a quick and an easy access to basic tax calculation and does not purport to give correct tax calculation in all circumstances. The gift tax exclusion for 2024 increased to $18,000 from $17,000.

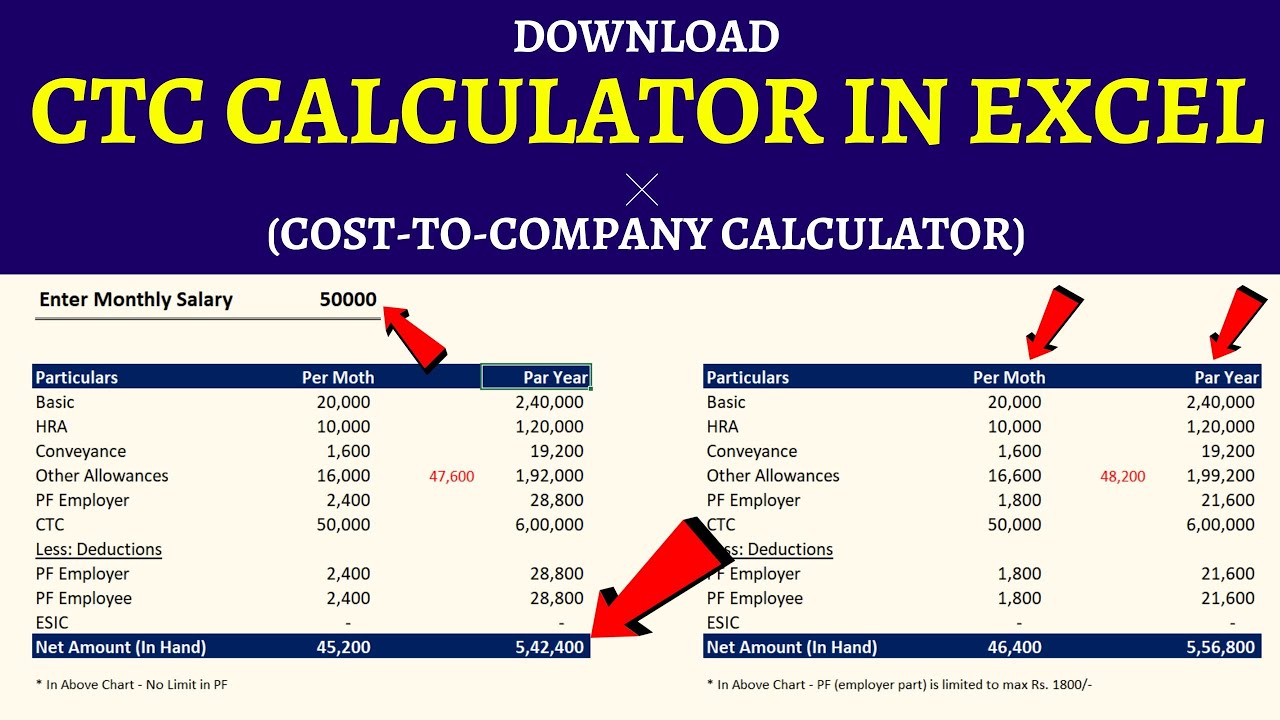

Download CTC Calculator in Excel 📊 Calculator) YouTube, But this year, the irs has stuck to their regular april 15 deadline. The child tax credit can significantly reduce your tax bill if you meet all seven requirements:

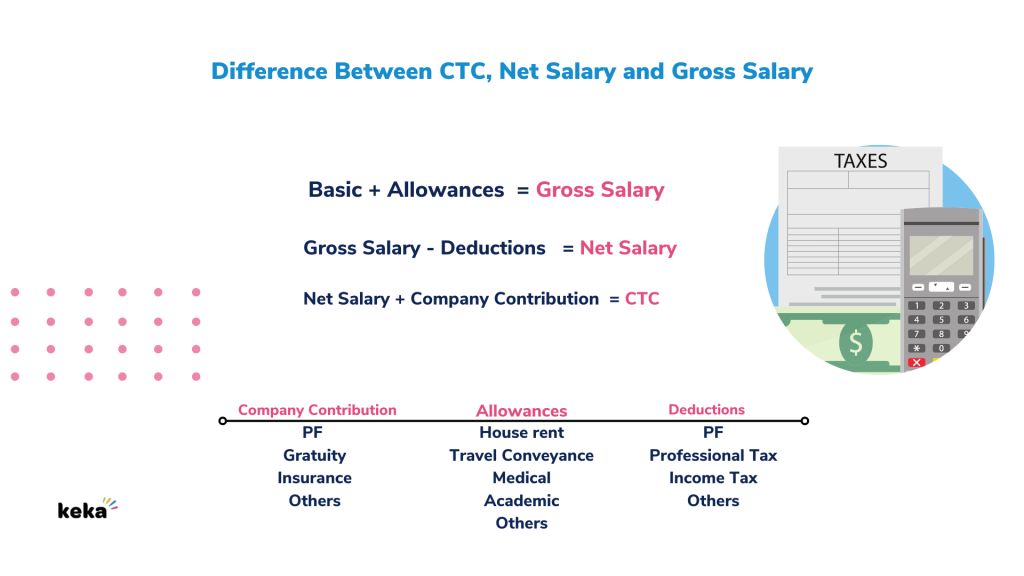

SALARY 2023 How to Calculate CTC, Salary & Tax 2023 New, The march 21 senate finance committee hearing with treasury secretary janet yellen on the. The gift tax exclusion for 2024 increased to $18,000 from $17,000.

Child Tax Credit CTC Update 2024, How to claim and track your. The child tax credit (ctc) is a federal tax benefit that plays an important role in providing financial support for taxpayers with children.

What is Cost to Company { CTC } ? Meaning & Definition Keka HR, Federal lawmakers have proposed a $78 billion bipartisan bill that enhances the child tax credit by providing more generous benefits to. But if you claimed the child tax credit and you're still.

IRS TAX REFUND 2023 IRS REFUND CALENDAR 2023 ? EITC, CTC, PATH ACT, A provision increases the refundable portion of the additional child tax credit (now capped at $1,600 per child) to $1,800 per child in 2023, $1,900 per child in 2024, and $2,000. The march 21 senate finance committee hearing with treasury secretary janet yellen on the.

Credit limit worksheet a Fill out & sign online DocHub, How is the expanded child tax credit different in 2023? The new calculation would multiply the parent's income by 15% as well as by the family's number of children.

How to Calculate Payroll Taxes, Methods, Examples, & More (2022), Federal lawmakers have proposed a $78 billion bipartisan bill that enhances the child tax credit by providing more generous benefits to. People should understand which credits and deductions they can claim and.

2023 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, This year, the ctc has been in the. But if you claimed the child tax credit and you're still.

TAX CREDITS 2023, EITC, CTC, ACTC 2023 IRS TAX REFUND UPDATE YouTube, The irs adjusts the income limits and credit amounts annually to account for inflation and economic changes, making it crucial for taxpayers to stay updated with the latest. If you end up owing less tax than the amount of the ctc, you may be able.

Here are the federal tax brackets for 2023 vs. 2022, Tax credits and deductions change the amount of a person's tax bill or refund. This year, the ctc has been in the.